Consult With an Experienced NFT Lawyer

Interested in creating an NFT collection? Or perhaps you're an NFT marketplace or development firm with legal questions? Whatever the case, the Kelly Law Firm can make sure your NFT enterprise falls in line with local, state, federal, and international regulations. We also mediate disputes between partners, draft and negotiate contracts, and advise investors and businesses on the crypto market, smart contracts, and how to make profitable NFT moves.

Our NFT Legal Practice Handles:

- Contract negotiations and drafting

- Issues related to the secondary trading market

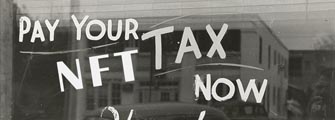

- NFT tax matters

- Creating NFT collections (business side)

- Smart contract terms and logic

- Industry guidance, including platform

consultations

- Intellectual property compliance

- Royalties and reselling

- NFT business formation

- Digital privacy compliance

- Asset protection guidance

- SEC, FinCen, and state agency registration compliance

What Are NFTs (Non-Fungible Tokens)?

NFTs — aka non-fungible tokens — are unique digital assets that use blockchain technology to track and record ownership and authenticity.

What's the Difference Between an NFT and a Normal Token?

The main difference between crypto tokens and NFTs is that the former is fungible and the latter is not.

In other words, bitcoins can be equally traded for another bitcoin. NFTs, on the other hand, are one-of-a-kind and cannot be exchanged for an identical token.

NFT Trivia: Did You Know?

NFT tokens contain unique keys that establish ownership and authenticity.

Common NFT Mediums

- Digital art

- Video and music clips

- Virtual trading cards

- Gaming collectibles

- Digital autographs

- Famous posts (i.e., the first tweet)

What Laws Affect NFT Creation, Sales, and Ownership?

Businesses and individuals looking to create NFT collections must comply with regulations and laws in various categories, including:

- Intellectual property torts

- Data privacy regulations

- Tax responsibilities

- Contract negotiations

- Anti-money laundering / Bank Secrecy Act

- SEC Act and various securities law obligations

- Financial and marketing consumer protection regulations (FTC and SEC)

NFT Promotional Regulations

Anyone selling NFTs must comply with unfair and deceptive marketing regulations. To avoid an action, don't misrepresent a token's worth or potential — either explicitly or implicitly.

NFT exchanges may also be held responsible for "turning the other cheek" in the face of users' blatant fraud.

Legal Tip for Crypto Exchanges

Exchanges and crypto investment platforms should have user terms absolving them of liabilities related to counterfeit, fraud, or user misconduct.

Authorship, publicity rights, licensing rights, and intellectual property rights are other factors to codify.

Five Common NFT Legal Considerations

Determine Rightful Ownership

Ensure everyone with content ownership rights is aware and agrees with selling the proposed content as an NFT. Neglecting this step can result in expensive legal disputes. Also, double-check that the royalty-generating content can change ownership. Many people fail to do this and run into problems right before launch. The last thing you want is to put in the hard work only to be thwarted at the last minute.

Review Relevant Securities Laws

Issuers and secondary marketplace platform operators where NFTs are bought and sold may be subject to securities regulation and oversight under laws governing securities traded on stock exchanges. Check with an NFT lawyer to ensure you're operating on the right side of the law.

Investigate Applicable Tax Issues

Proceeds from NFT sales are taxable. Moreover, NFT purchasers can face higher tax liability due to crypto volatility. If an NFT is purchased with crypto and undergoes volatile conversion rates or whirlwind appreciation, the taxes associated with those gains can be unpredictable.

Anti-Money Laundering Laws

NFTs can be susceptible to fraud and money laundering, and unassuming parties may be at risk.

For example, a music royalty stream with a spike in listenership may be due to an artist's success, or it may reflect shady dealings behind the scenes. With blockchain decentralization and low transparency, identifying or locating initial or secondary buyers may be difficult.

To reduce risk, stick to controlled marketplaces that monitor their markets for signs of fraud.

International NFT Laws

It makes sense to capitalize on international NFT sales and resales. However, before selling abroad, make sure all your legal ducks are in a row. Failing to do so can lead to intellectual property loss.

NFT issuers should maintain jurisdictional control over where NFTs are sold. Working with an attorney who has a deep understanding of the regulations in those areas can protect you from inadvertently breaking the law.

NFT Law FAQ

What Does NFT Mean?

NFT stands for non-fungible token — which means the coin in question cannot be traded or exchanged for one of equal value. For example, if you give someone a five-dollar bill and they give you five singles back, it's an equal exchange, making the currency "fungible." But NFTs are one-of-a-kind and cannot be traded for similar tokens.

What Is an NFT in Law?

Legally, NFTs are an asset class and subject to applicable taxes.

One of the biggest mistakes people make, legally speaking, with NFTs is that they think they own the work or creation associated with the token. That is not the case. Blockchain intellectual property law is complicated, and many parties may "own" certain parts of a given transaction or receive royalties on resales.

NFTs are an emerging digital asset class linked to collectibles, art, and other digital objects of interest. However, the realm of possibilities is mushrooming, and some NFTs are now connected to homes, boats, and other real property. NFTs can be coded to cover almost anything unique, from land titles to works of art.

Are NFTs Legally Binding?

Sometimes, people confuse "smart contracts" with "NFTs." It's an understandable confusion for people just starting to explore the crypto and blockchain landscape. In the simplest terms, smart contracts are what control NFTs on a blockchain. Think of smart contracts as digital agreements that are activated anytime something happens with a token. Be aware, though, that smart contracts cannot be changed.

Click here to learn more about smart contracts.

So, in response to the question, "are NFTs legally binding," the answer is "depends." For what is the NFT being used? What was the initial agreement? If you want to determine the legality of a given NFT deal, consult a blockchain attorney.

Are NFTs Legal in the United States?

Yes, NFTs are legal in the United States. However, exchanges and wallets are subject to many regulations — including state money transmitter rules and federal SEC, FINRA, and anti-money laundering regulations. Plus, basic contractual and intellectual property rules may apply, depending on how an NFT deal is structured.

What Legal Issues May Arise in the Buying, Selling, and Facilitating of NFTs?

Right now, the NFT market is still in its infancy. A patchwork of regulations governs the space, and anyone planning to launch a collection should consult with an NFT lawyer before making any big moves. Generally speaking, issues related to intellectual property rights, cybersecurity, financial regulations, and anti-money laundering statutes must be considered when minting and facilitating NFT trades.

When Did NFTs Become Popular?

NFTs have been around since about 2012 but didn't capture the public's imagination until 2021. People from all walks of life — including celebrities, professional athletes, and programming prodigies living in Europe — got in on the market. The art world has also leveraged the technology to facilitate cutting-edge auctions.

It's important to understand that NFTs are about provenance clout, but buyers typically do not own the actual work itself.

Does it Cost Money To Create an NFT?

Yes, creating an NFT may cost money depending on the type and purpose. If it's a legitimate commercial venture, you'll need NFT legal advice. Regulatory levies may also apply, depending on your jurisdiction. Other fees you could incur to create an NFT include:

- Hiring a programmer / minting fees

- Securing a crypto wallet and related software

- Account and auction transaction fees on platforms like Rarible, Foundation, Opensea, and Nifty Gateway, or niche ones like the Axie Marketplace

- Gas fees

- Sales fees

What Is Contained on an NFT Token?

Some NFTs hold more information than others, but generally, in addition to meta information, they contain a unique key that confirms the object's authenticity and ownership.

Can NFTs Be Altered?

Once an NFT is deployed on a blockchain, it cannot be altered without interference in the form of a corrective smart contract.

How Are NFTs Made?

NFTs are created on blockchain databases. Typically, engineers use the Ethereum blockchain via the ERC-721 token standard, but other options are opening up, including Flow, Tron, EOS, and Cardano. NFTs are coded using the Solidity programming language.

How Do Regulators Treat NFTs in the United States?

NFTs are difficult to classify because they can be linked to myriad assets. Federal regulators have yet to provide guidance on NFTs. However, if we were to speculate, some types of NFTs — like a "fractional" NFT (f-NFT) that operated as an investment contract under the Howey Test — could be seen as commodities governed by the Commodity Exchange Act. Hypothetical NFTS of this variety would be subject to regulations detailed in the Securities Act of 1933 and the Securities Exchange Act of 1934.

The Commodity Futures Trading Commission includes cryptocurrencies and renewable energy credits as commodities already. If you're treating an NFT like a commodity, you must comply with unfair and deceptive marketing prohibitions and only trade on registered exchanges — unless the NFT is delivered within 28 days of purchase.

Are Intellectual Property Rights Transferred in a Sale of an NFT?

NFT sellers typically dictate the attached intellectual property rights, and they're often coded into the smart contract. It's wise to include transfer, assignment, and licensing language — including restrictions — in the agreement.

What About NFTs and Anti-Money Laundering Laws?

The Financial Crimes Enforcement Network enforces the U.S. Bank Secrecy Act and other federal anti-money laundering laws. So far, FinCen hasn't released guidance that specifically relates to NFTs, but it has weighed in on virtual currencies. If a given NFT is a money substitute, it is subject to anti-money laundering measures.

But in all likelihood, NFTs should be clear of FinCen's prying eyes since they're digital representations of ownership, not a currency substitute.

The Office of Foreign Assets Controls, or OFAC, also has regulatory sway over crypto products. Since the agency is notoriously suspicious of financial and asset products that allow for a high degree of anonymity, it's keeping an eye on the NFT market.

Is It Possible To Hack NFTs?

Theoretically, yes, it's possible to hack NFTs, but it requires advanced programming skills. If an unauthorized party can get their hands on the private keys associated with NFTs, they can move and sell them without authorization. As such, NFT marketplaces and companies must invest heavily in cybersecurity measures and have the proper legal protections in place.

Do I Need To Get Permission From Copyright Holders To Create Multi-Media NFTs?

Yes, if your NFT includes someone else's content, artwork, or music, you need to secure permission from the copyright owner to use it before minting the NFT. Depending on the NFT's terms, you may need to negotiate rights to publicly display, reproduce, prepare derivatives, publicly perform, and distribute copies. And sorry, you cannot claim Fair Use in this instance.

What Advice Would You Give People New to the NFT Market?

Right now, the NFT market is in Wild West mode. Rules and regulations vary from platform to platform. If you're planning to commercialize NFTs you buy, consult with an NFT lawyer first.

How Do Smart Contracts Affect NFTs?

All NFTs are inextricably linked to smart contracts, aka digitally encrypted terms. The logic and legal backbone of blockchain environments, smart contracts cannot be altered. The only way to nullify or change a smart contract is by deploying a corrective one.

Their immutability is largely seen as a feature, not a bug. Unlike traditional transactions, smart contracts run on binary logic alone. Like clockwork, they can dole out royalty and payroll payments alike.

However, legal questions still loom over smart contracts and their enforceability. Some jurisdictions have amended laws to ensure blockchain contracts hold the same legal weight as paper contracts. But to date, it's still a largely untested area of law.

Must I Pay Taxes on NFTs?

The IRS expects investors — of fiat and digital currencies — to pay capital gains taxes. It's a complicated formula, so consult with a cryptocurrency tax attorney if you have gains and losses of over $30,000 in crypto or NFT investing.

Consult With an NFT Lawyer

The Kelly Law Firm can help guide you through the NFT process, from minting to marketing. We'll make sure your agreements and smart contracts are correctly structured. Our firm also handles NFT negotiations, like royalty and commission splits and developing profit strategies that comply with state, federal, and international laws.