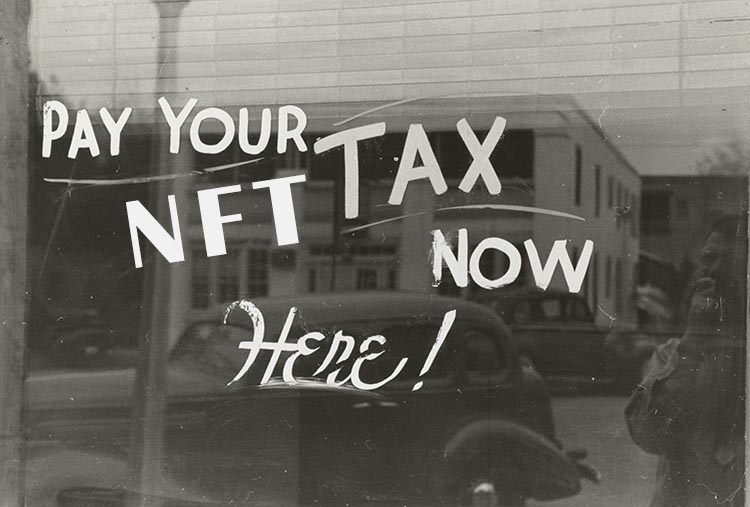

If you landed here, you’re probably wondering about NFT tax rules. Must you report NFT gains and losses to the Internal Revenue Service? Can the IRS charge you with a felony if you don’t? We’ve got answers.

If you landed here, you’re probably wondering about NFT tax rules. Must you report NFT gains and losses to the Internal Revenue Service? Can the IRS charge you with a felony if you don’t? We’ve got answers.

What Is an NFT?

Before we dive into some NFT tax law questions, let’s quickly review the current NFT landscape.

NFT Basics

NFT stands for non-fungible token. Each one is unique and carries a robust set of programmable actions. Technically, NFTs are tracked on a public digital ledger.

However, they’re encrypted, so identities are kept anonymous. Plus, individual NFTs can have both public, semi-public, and private parts.

For example, Quentin Tarantino’s upcoming Pulp Fiction NFT opportunity features NFTs with both a public ledger side and a private component that only the buyer can see.

The Rise of NFTs

NFTs catapulted into prominence between 2020 and 2021. And while naysayers think the NFT market is a passing fad that’s bound to go the way of tulips, brands and businesses are making plans to leverage the technology.

In other words, if you’re looking for the next big thing, aligning yourself with a promising NFT startup isn’t the worst idea. Do proper due diligence beforehand to ensure it’s a legitimate initiative with reputable backers, and you should be good to go. (You can also hire an NFT lawyer to do some reconnaissance work.)

Why Do NFTs Have a Bad Rap in Some Circles?

Some people saw the potential of NFTs immediately, but a chunk of the population remains skeptical.

Why?

For starters, it’s something new. For over 3,000 years, humans have used a cash-based monetary system controlled by central authorities. We built our societies around the traditional approach and have clung to it ever since. Introducing new modalities will take a while.

The irony, though, is that the “collectibles” arm of the NFT market isn’t all that different from the traditional art market or even the stock market.

Secondly, the way the media reports on cryptos and NFTs veers toward the sensational. Outlets favor headlines and stories about eye-popping sales — like the first tweet, which went for over $2 million, and Beeple’s $69-million NFT auction via Christie’s — and frame the NFT market as a murky, foolhardy demimonde where crime syndicates spend a lot of time. The more shocking and outlandish, the better.

What many NFT skeptics don’t consider, however, is the versatility of the underlying technology and its market-making potential. Click here to learn more about the potential value of NFTs.

Must You Report Large NFT Sales to the IRS?

In a word: yes. Taxpayers must report asset gains and losses over $10,000.

Moreover, federal officials recently ratified a bipartisan $1.2 trillion infrastructure bill, and a portion of it addresses cryptocurrency and NFT taxes. Under the provisions, “brokerages” — aka exchanges — must report transactions over $10,000 to the IRS.

Can You Be Charged With a Felony for Failing to Report NFT Gains?

Technically, yes. It’s possible to be charged with a felony for failing to report NFT gains. HOWEVER — and that’s a purposefully oversized “however” — the chances of it happening at this point are between slim and none. Not impossible, but highly unlikely.

Why?

For starters, the industry is still in its infancy, and we’re still in the regulatory testing phase. That doesn’t mean you should ignore applicable rules and statutes — because authorities will and do go after violators. But people who make honest mistakes shouldn’t be quaking in their boots. Yes, sit down with a professional who can help you address the issue. But no, you probably don’t need to do a Tom-Wambsgans-esque prison prep.

If you’ve kept your NFT activity off your taxes, it’s probably time to sit down with a crypto tax account or attorney to sort things out. Tackling the matter now will prevent it from mushrooming into a major headache down the road.

Connect With an NFT Attorney

The Kelly Law Firm works with businesses and individuals on various NFT transactional issues. We handle contracts, business and governance consultations, in addition to intellectual property and marketing matters. If you need assistance, let’s talk.

If you need help with NFT taxes, we can put you in contact with accountants and lawyers who focus on the tax side of the law.